How long should you keep your tax-related records? What do you do with all of the supporting documentation? Do you have to keep all that, too?

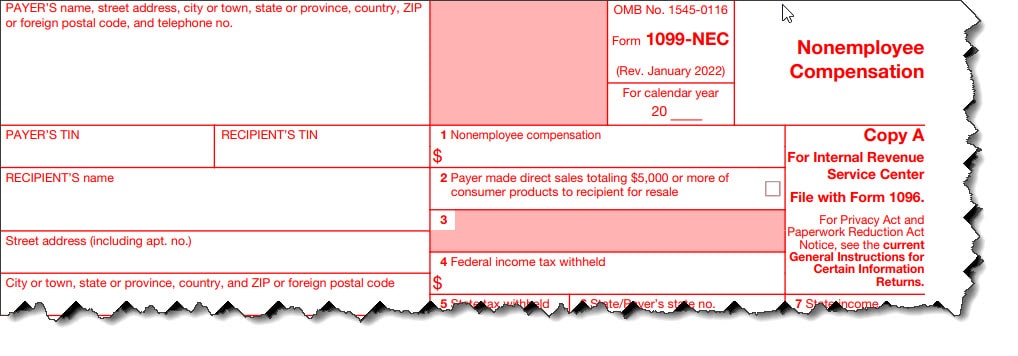

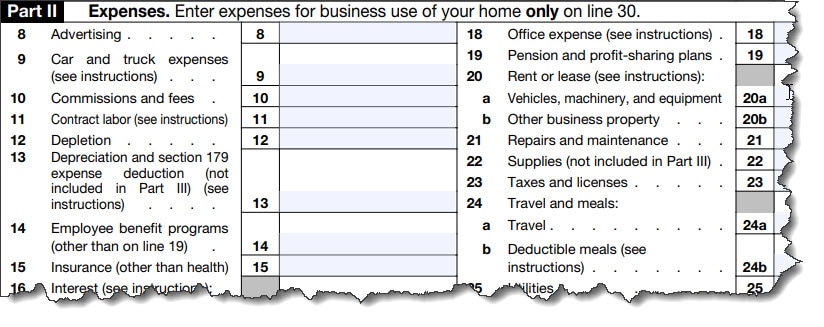

These common questions stump taxpayers: How long do Form 1040 filers (individuals and small businesses) have to keep those 1040s and the Schedule As and Schedule Cs? What about the 1099s and W-2s? Do you also have to keep supporting documentation, like property tax statements and business receipts?

Short answer to the first question: three years from filing your tax return or two years from paying the tax, whichever is later. It represents the IRS’ period of limitations. It’s the allotted time when the IRS can assess additional tax. It’s also when you can amend a return to claim a credit or refund.

And yes, you must store your copies of tax forms like the W-2s and 1099s. You must also keep documents supporting the information supplied on your tax return. That includes:

- Income

- Expenses

- Any document related to the property

- Investment documents

You also need to keep all official IRS forms for three years.

Other Situations

Like any other IRS rule or regulation, the three-year rule has exceptions. Here are a few of them.

Six Years.

Suppose you failed to report any income that you should have reported, and it was more than 25% of your gross income as shown on your return or can be attributed to foreign financial assets representing more than $5,000; the IRS can assess your taxes up to six years after you file your return.

Seven Years.

Keep your return and documentation for seven years when claiming a loss from a bad debt deduction or worthless securities.

No Limit.

If you didn’t file a return or filed a fraudulent one, there’s no period of limitations.

The IRS advises that even after the period of limitations is up, you may still want to retain your records if, for example, your insurance companies or creditors wish to access them.

What About Credits or Refunds You Should Have Received?

You can claim a refund or credit up to:

- Two years after you paid the tax, or

- Three years after you submitted the original return, or

- Three years after the filing deadline if you filed before it.

The IRS uses the latest of these dates as its deadlines. To get the process going, it’s best to catch errors and omissions as soon as possible. To get the process going, it’s best to catch errors and omissions as soon as possible.

How Should You Store Records of Expenses and Income?

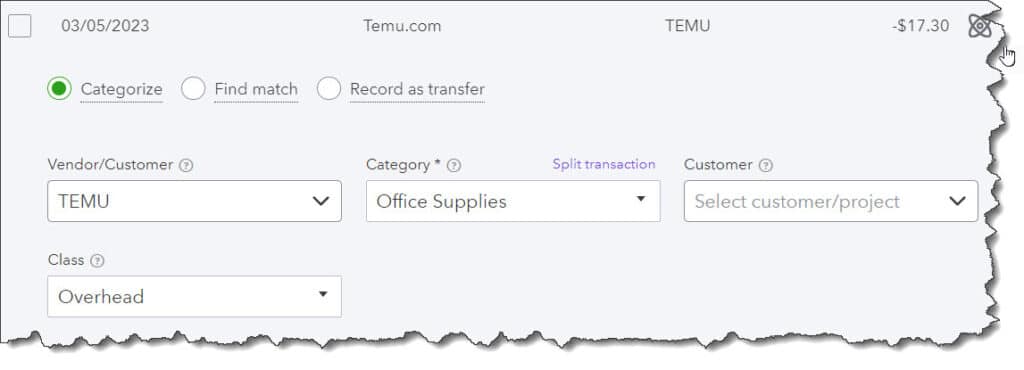

Do it the old-fashioned way; keep your paper receipts and other documentation supporting your expenses and income in file folders or large envelopes in a safe place. Suppose you’re using a financial application like Mint (personal finance), QuickBooks Online (small business accounting), or Wave (both). In that case, the IRS might ask permission to access your files.

QuickBooks Online and other financial applications let you import, store, and categorize tax-related expenses and income.

If nothing else, you can print your records if needed, so you don’t have to store all that paper. It’s another good reason to always have a current backup of your online financial files.

Suppose you need to use a personal finance or small business web-based solution. In that case, consider it, especially if you have business expenses and income to track for your income taxes. Some applications, like Wave (H&R Block) and Mint (Intuit), are free. They’re easy to set up and use. You only need to give your online bank account usernames and passwords, and they can import your transactions. You can categorize them so you know where they must go on your Schedule C. Reports can help you group certain transactions with the same categories.

Categorizing your financial transactions makes assigning them to your Schedule C much more effortless.

We’re Here to Help

Do you still have questions about what to do if you should have gotten a credit or refund after you’ve filed your taxes? Should you still file for a year when you didn’t? Have you finished your 2022 taxes yet? Give us a call or email. We can schedule a time to get it all sorted out.